How to Read Btc Short and Btc Long

How To Read Crypto Charts guide

Learning how to read crypto charts is an essential skill if you desire to get into trading. Having said that, learning technical analysis and all the jargon that goes along with information technology tin can be pretty intimidating for beginners. This is why we have written this guide to ease your journey.

NOTE: Bullish move is an up and positive movement and bearish move is a downwards or negative motility. Bulls/buyers desire to take the market place cost upwards by buying the crypto and bears/sellers take the market price below by selling crypto.

Acquire How To Read Crypto Charts- Ultimate Guide

What is the Dow Theory?

It is essential to know the Dow Theory to have a improve grasp of technical analysis. The fundamental ideas behind Dow Theory are as follows:

- The market takes everything into consideration during its pricing. All existing, prior, and upcoming details have already been integrated into current asset prices.

- When information technology comes to crypto the things that are considered are multiple variables like current, past, and hereafter demands and any sort of regulations that may impact the crypto market.

- Price movements are not exactly random. They follow trends by and large and it may either exist long or short-term.

- Market analysts are focussed on the price of a coin rather than every single variable that produces a movement in its price.

History tends to get repeated. Considering of this reason, it is possible to predict market behavior as traders react the same way when presented with a item kind of blueprint.

The Six Tenets of Dow Theory

Dow theory has 6 basic tenets. They are as follows:

#1 The three movements of the market

- The primary move is the "main movement" which is a major trend and may last from less than a year to several years. It tin exist bullish or surly.

- Then we have the medium swing which is a secondary or intermediate reaction and may last from ten days to three months. It generally retraces from 33% to 66% of the principal price change since the previous medium swing or kickoff of the main movement.

- Finally, we take the short swing or minor movement varies co-ordinate to market speculation from hours to a month or more than.

These iii movements tin can happen simultaneously, for instance, a daily minor movement in a surly secondary reaction in a bullish primary motion.

#2 Three phases of market trends

In that location are three phases of major market trends:

Aggregating phase: This is the flow when knowledgable investors start buying or selling the nugget against the general perception of the market. During this stage of the market, the toll of the nugget doesn't alter much because these knowledgable investors are in the minority.

Absorption (or public participation) phase: Somewhen the market catches on to these "intelligent investors" and they follow their tendency. More and more people follow these trends until rampant speculation begins.

Distribution phase: After huge speculation, considering of the express supply of the asset, the cost begins to retrace as the knowledgable investors brainstorm to distribute their holdings to the market. As a result of information technology the prices outset falling along with the volume.

#3 The stock market discounts all news

The stock market place incorporates new information every bit presently as it becomes bachelor. In one case this news is released, the price of the asset changes to reflect this new information. The toll reflects the sum of all the hopes, fears, and expectations of all the marketplace participants. Factors such as interest rate movements, earning expectations, revenue projections, major elections, product initiatives, etc. are all integrated into the market price.

#4 The stock market averages must confirm each other

To understand how this works, consider this example. There is a company A and a company B. Suppose A is a handicrafts company and B is a transportation company. A uses B'due south service to transport their products. Now, if A gets more business organisation, and then B volition become more concern as well since A will demand B to ship their goods and vice-versa.

And so, if an investor is interested in investing in company A, they demand to wait at the performance of visitor B. These two averages should exist moving in the same management. If these two averages are diverging, then information technology is a sign that market trend may exist reversing soon.

#5 Trends go confirmed by volume

Dow Jones believes that volume is a secondary withal of import factor in recognizing price signals. This is how book reacts during major trends:

- During an uptrend, volume should increase with the increase in toll.

- During a downtrend, volume decreases with a decrease in price.

#6 The trends will exist until definitive signals show that they have ended

This tenet is a lot like Newton's showtime law of motion i.eastward. an object in move tends to remain in motion unless acted upon by an external strength. Similarly, the Dow believes that the market remains in trend despite "market noise." Determining a reversal in tendency is not easy.

What is Technical Analysis?

Now that nosotros know the 6 tenets of the Dow Theory let'southward wait into what technical analysis is. Technical assay is a tool, or method, used to predict the probable future price move of a currency pair, cryptocurrency pair, or a stock. Information technology can be a creative and dynamic which helps you gain a very deep perspective into the marketplace.

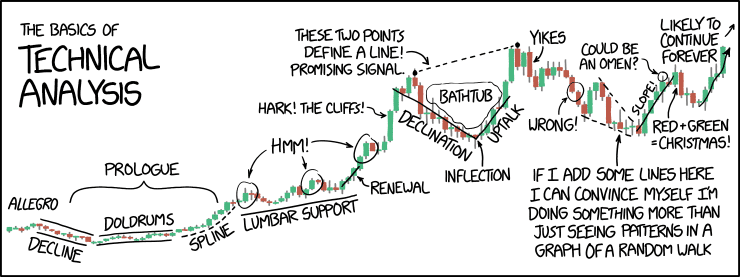

Image Credit: xkcd

Don't worry, technical assay isn't as complicated or scary as that! So, allow'southward get started.

Different Time Frames for Crypto Charts

When a technical annotator examines the toll chart, along with the technical tools, they too need to be mindful of the time frames that they are because. Popular time frames that traders nearly frequently examine include:

- 15-minute chart

- Hourly nautical chart

- iv-hour chart

- Daily nautical chart (1-Twenty-four hours)

The time-frame that a trader chooses is direct dependent on their personal trading-way. Traders broadly fall into 2 categories:

Intra-twenty-four hours traders: These are the traders who open and close their position inside a single twenty-four hour period. This is why these traders adopt short timeframes like hourly, 15-min, or even 5-min charts.

Long-term holders: Long-term holders may concur their position for weeks to months and years. These holders find more value in using hourly, 4-hour, daily, or fifty-fifty weekly charts.

A xv-min chart may be a very pregnant indicator for an intra-day trader but it may non exist that important for a long-term holder.

Cryptocurrency Market Cap

Market cap of a coin is calculated using this formula:

Marketplace cap = Total Circulating Supply * Cost of each coin.

In other words, it is a product of the coin's circulating supply and the cost of each coin. Let's take an case:

If "A Coin" has 300,000 coins in apportionment and each coin is worth $2, the A Coin'south market cap will be 300,000*2 = $600,000.

You lot can bank check the marketplace cap of the top 100 cryptocurrencies on coinmarketcap.com.

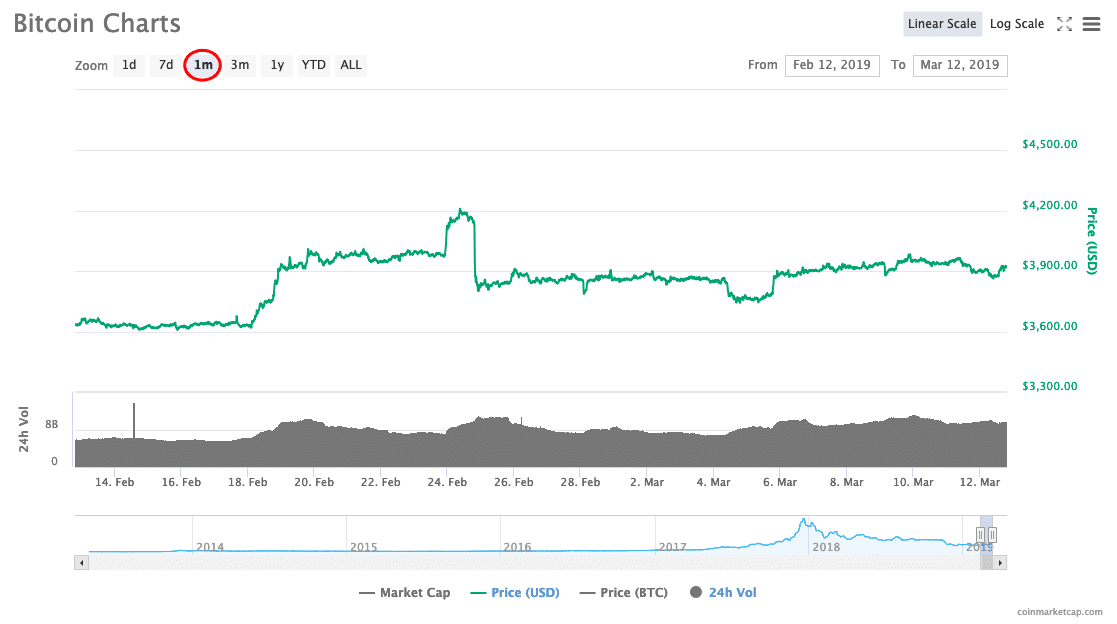

Market cap is a bully indicator to know well-nigh the stability of a coin. In fact, go to coinmarketcap right now and check Bitcoin's market cap. This is how its monthly marketcap looks similar:

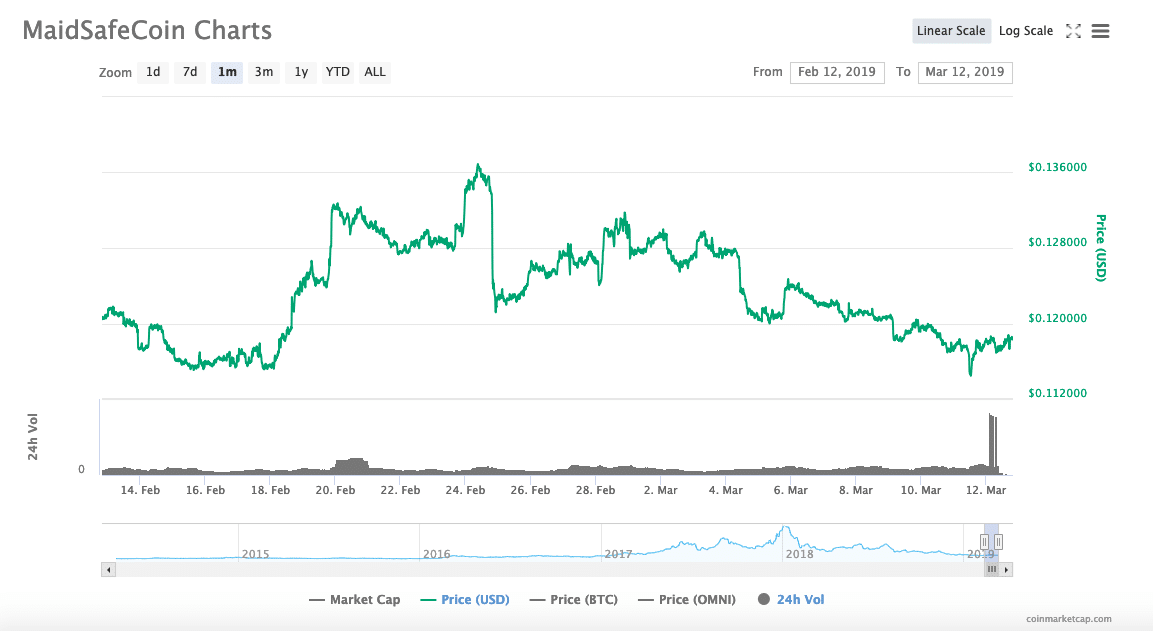

As you can run across, Bitcoin's value has been pretty stable for the terminal one month. At present compare that with MaidSafeCoin.

As you can see, compared to Bitcoin, MaidSafeCoin is a lot more volatile.

The Japanese Candlestick Charts

By far the nearly popular chart out there. If yous have fifty-fifty visited an exchange's website, then in that location is a chance that you have seen these before:

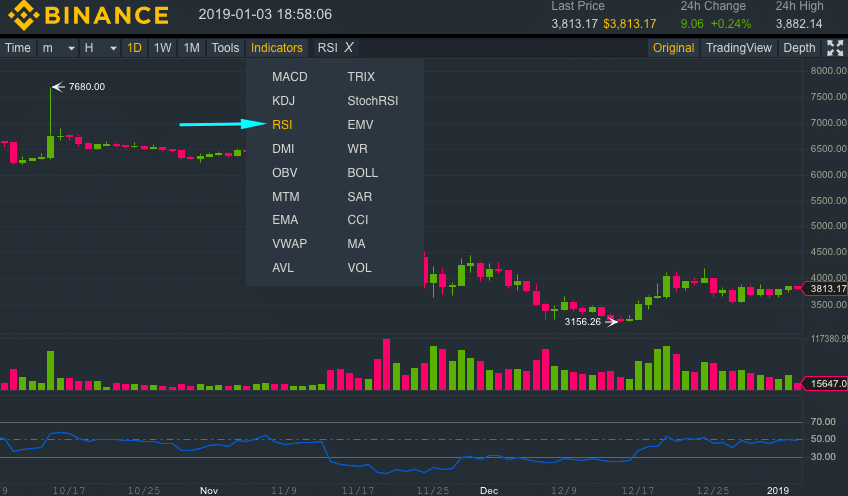

The graph in a higher place is the daily candlestick chart for BTC/USDT in Binance. What we are going to do at present is to aid you make sense out of those pretty patterns. The first thing you lot will observe is the red and green candlesticks lying one after another. Each candle shows you the cost movement of the asset during a specific time interval.

So, what does each of these candlesticks correspond?

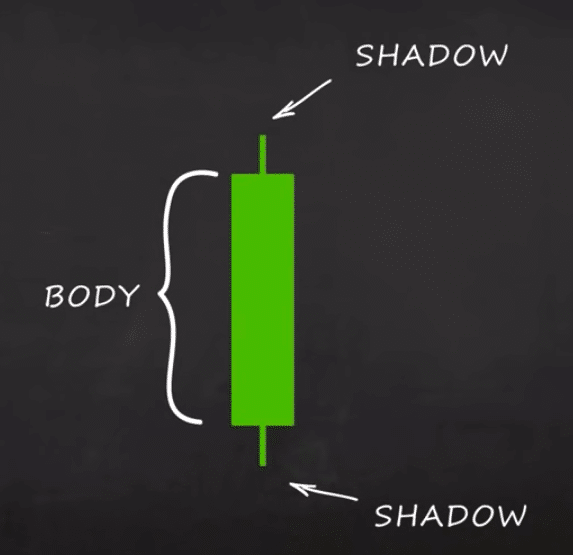

Forth with the closing price, each candle shows the opening price, the lowest, and highest price of the given time-menstruation as well as the closing price. As you can likewise see, there are to kinds of candlesticks, the green candle, and the ruby candle.

Every candle has a body and a couple of shadows that are sticking out of it. The body shows you the departure between the opening and closing price. The shadows evidence yous how high or how low have these opening and closing prices have gone respectively. In a green candle, the upper shadow is the shut price while the lower shadow in the open price and vice-versa for reddish candlesticks.

The beauty of these candlesticks is that it clearly shows you lot exactly where the market place turned and helps you lot identify different patterns which may assist you predict how the market will act.

Having said that, permit's look at 3 bullish and bearish reversal patterns on our candlestick graph.

Bullish Reversal Patterns

#one Hammer

The hammer is a 1-candle pattern which has:

- Little to no upper shadow

- Price closing at the top quarter of the range

- The lower shadow is two or three times the length of the trunk

A hammer is a bullish reversal pattern that forms after a decline in price. And so, what does it exactly mean?

- Equally the marketplace opened, the sellers took control of it and decreased the cost.

- However, at the end of the selling menses, buying momentum came back in and pushed the price higher.

- This momentum was so stiff that the endmost price finished above the opening price.

The hammer signifies a bullish reversal and shows that the buyers are coming in strong into the market.

#2 Bullish Engulfing Design

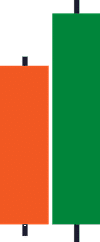

The Bullish Engulfing Pattern is a two-candle pattern. This is how yous recognize this:

The first candle is surly while the second candle is bullish.

The body of the second candle completely overwhelms and covers the first candle.

What does this pattern mean:

- On the bearish candle, the sellers are in control.

- On the second candle, the bulls hit dorsum with a strong rally and completely overwhelmed the bears.

The reason why this is such a nifty indicator is that the bulls have increasingly stronger momentum

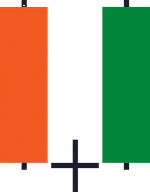

#3 Morn Star

A morning star is a iii-candle bullish reversal pattern which forms after a decline in the cost. This is how y'all recognize information technology:

- The first candle is surly in nature.

- The second candle has an extremely small range.

- The third candle exhibits an aggressive upwards momentum.

Why does it do that?

- The sellers are in control as the price closes lower in the first candle.

- The 2nd candle is an intriguing one equally the buyers and sellers pretty much cancel each other out here.

- In the 3rd candle, the buyers completely take over and close the toll higher.

The morning star pattern tells you that the sellers accept been exhausted after fighting with the buyers and the market is now bullish.

Bearish Reversal Patterns

Now allow'southward await at three bearish reversal patterns. All these patterns are the reverse of the three bullish reversal patterns.

#one Shooting star

The falling star is a 1-candle bearish reversal pattern. This is how you recognize it:

- Petty to no lower shadow.

- Price closes at the lesser ¼ of the range.

- Upper shadow is nigh 2 or 3 times the length of the body.

What does this hateful?

The buyers took control as the market opened and pushed the price loftier.

At the close, there was huge selling pressure from the bears.

The selling momentum was so strong that it overwhelmed the bulls.

In short, a Falling star signifies a bearish reversal and shows that the sellers are coming in strong into the market.

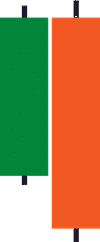

#2 Bearish Engulfing Pattern

A Bearish Engulfing Pattern is a 2-candle bearish reversal candlestick blueprint.

So, how do you recognize this pattern?

- The kickoff candle is bullish in nature.

- The second candle is surly and large enough to overwhelm the kickoff candle.

This is what the Bearish Engulfing Pattern ways:

- The buyers are in command in the first candle.

- Nonetheless, the sellers take over and the selling momentum is so potent that the market closes lower than the previous candle'south low.

The Bearish Engulfing Blueprint tells yous the sellers have overwhelmed the buyers and are at present in control

#3 Evening Star

An Evening Star is a 3-candle bearish reversal candlestick pattern. This is how yous recognize this pattern:

- The commencement candle has a bullish close.

- The second candle has a small range.

- The tertiary candle has an aggressive bearish close.

What does this pattern mean?

- The first candle shows that the buyers take taken control and closed the cost higher.

- The 2d candle is a standoff between the bulls and bears.

- The third candle shows that bullish momentum has been exhausted and the sellers have taken over.

The Evening Star tells you lot the buyers are exhausted and the sellers are momentarily in command.

Relative Strength Index

Relative Strength Index or RSI measures the force and speed of a market'due south toll movement by comparison the electric current price of a cryptocurrency to its past performance. It works by comparing the magnitude of recent gains to contempo losses to decide whether crypto has been overbought or oversold.

The formula looks similar this:

RSI = 100 – (100/(1-RS))

In the equation above, RS is the ratio between the boilerplate of the days the coin was upwards to the average of the days the coin was down.

Now, thankfully you don't need to bother about calculating anything, because the substitution will do it for y'all.

So, allow's have a await into how the RSI graph looks like. Nosotros volition bank check the BTC/USDT chart from binance.

We will choose "RSI" from the Indicators menu.

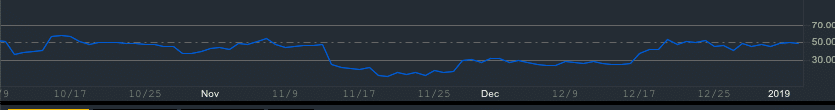

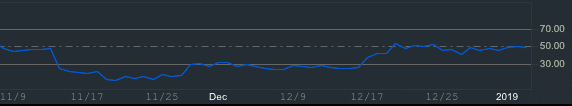

When you practice and then, the blue graph will appear below the candlestick nautical chart.

Keep in mind, we are checking the daily RSI.

Ok, then there are a few things to keep in mind when we are checking the RSI graph.

- The RSI ranges from 0 to 100

- When the RSI for a item coin approaches 70 or even crosses 70, then it is considered to be "overbought" aka the crypto in question is getting overvalued, so information technology may go downward.

- On the other hand, if RSI approaches 30, then the crypto is undervalued and volition probably get up in value shortly.

While RSI is a pretty useful indicator, the truth is that information technology isn't immune to false buy and imitation sell signal which tin can be created by either a large rally or a meaning driblet in the cost of the crypto. This is why RSI should be a tool that y'all use along with other indicators to predict the future cost of a coin.

So, let'south look into our RSI graph, especially in this section:

Around 14th November, the RSI of BTC/USDT went below 30, into the undersold area. However, since the market was downward, the RSI finally went up on November cease, rallied around thirty for a chip before finally going upwardly around 17th December.

Along with RSI, you should also look into moving average and Bollinger bands. You can learn more hither.

What are Support and Resistance?

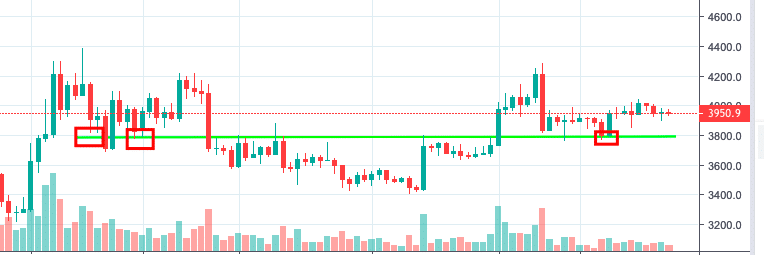

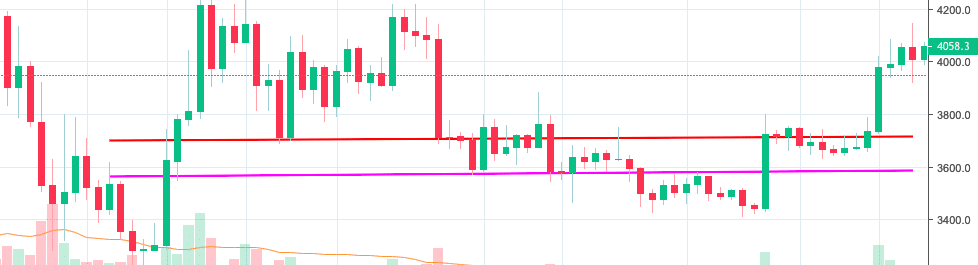

In technical analysis, back up and resistance are predetermined levels of the cost of an asset at which the tends to reverse its trend. These levels are denoted past multiple touches of price without a breakthrough of the level. Traders oft buy at support and sell at resistance. In order to see how support and resistance levels piece of work, let's look at the daily BTC/USD chart from Bitfinex.

Support

A support level is where the price of an asset tends to end falling. Check out the nautical chart below.

Upon close exam, you lot will meet that we accept called the $3,800 line as a support level. The reason why nosotros have called this is that at three distinct points (every bit highlighted by the carmine box), the market came down to that level then picked itself back up.

This can happen due to multiple reasons which nosotros will talk over later. However, to just requite you lot a brief idea of how the dynamics works, the sellers (or bears) sell off the asset and bring the price downwardly. The moment the price comes down to a certain level, in this case, $3,800 and the buyers storm back in and "bounce" the price of the asset off this level.

If the sellers are carrying plenty momentum and really manage to breach by this level, the price will continue falling until it reaches another support level. Eg. in the following nautical chart:

The price of BTC/USD broke past the commencement support level (carmine line) so found a second support level (pink line) which it used to bounce off of. The cerise line now becomes a resistance level.

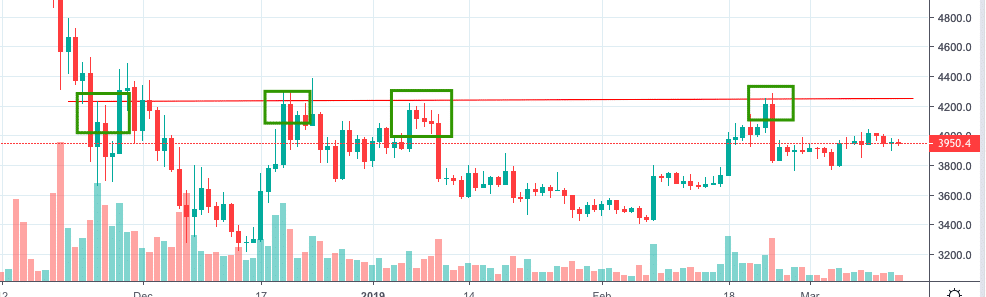

Resistance

A resistance level is a indicate at which the price of the asset stops rising. Check out the nautical chart below.

Resistance is opposite to the support level. The BTC/USD daily nautical chart establish resistance at $4,250. Every bit you tin can see, the chart meets the level at four singled-out points and bounces down. To show you how it works, the buyers buy the asset until the toll of the nugget increases. However, in one case information technology reaches $4,250, the sellers sell the asset.

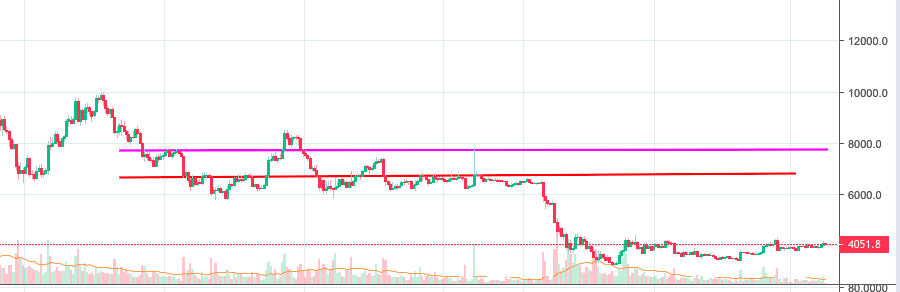

However, if the buyers have enough momentum to alienation by $four,250, then the price will continue to rise until it reaches another resistance level. Upon the breach, the $4,250 resistance level now becomes back up. Bank check this out:

Here BTC/USD broke past $7,000 resistance (crimson line) and and then reached second resistance at $7,800.

Participants in the Market

So, to understand why the market creates back up and resistance levels, you need to understand the psychology of the marketplace. In a market place, in that location are typically iii types of participants, at any given cost level:

- Traders who are going long and waiting for the cost to rise.

- Traders who are going brusque and waiting for the price to fall.

- Traders who don't know which way to get.

#1 Price rising from support

When the price bounces off a support level and goes upwardly, the iii participants react like this:

- The traders who are going long are actually happy with the state of the marketplace. They may also try to add fifty-fifty more than to their position if the price drops doing to the aforementioned support level.

- The traders who are going brusque may second-guess their position and try to purchase in more to breakeven as the price reaches the support level once more.

The traders who didn't enter the market previously may want to expect for the price to get back down to the support level to enter the market.

Then, this support line becomes a great level where all the 3 kinds of traders tin buy in.

#two Price falling through support

Cost can autumn through a back up level and meet support at another level. In this case, the original support level becomes resistance. So this is how the 3 participants act now:

- The traders who go long will look for the toll to come to the original support level and sell their assets there to limit losses.

- This plays in the hands of the short traders who will desire to add more to their position.

Finally, traders who oasis't entered the marketplace yet will decide to go short.

So, this back up line becomes a great level where all the three kinds of traders can sell at.

Support and Resistance = Market Emotions

The biggest factor behind price movements are emotions like fear, greed, optimism, and pessimism. You tin think of a toll chart as a graphical representation. When the cost falls down to the support level, greed/optimism kicks in and the long traders purchase the nugget to add together to their position. Meanwhile, the short traders will purchase in more to cover for losses.

Now, every bit more and more traders buy in, herd mentality kicks and the cost raises up from the support line. Similarly, when the cost goes up, fear/pessimism kicks in from the traders and they sell off their avails to make sure they don't incur any losses.

The reason why emotional price levels like support and resistance are so significant is that they attract a lot of attention and create apprehension. This attention attracts a big number of volume and traders.

Decision: How To Read Crypto Charts

Till now we accept discussed market cap, candlesticks, and relative strength alphabetize. In the second part, we are going to talk nearly trending lines, moving averages, and Bollinger bands. Don't worry, information technology's not every bit scary as information technology sounds!

How to Read Btc Short and Btc Long

Source: https://blockgeeks.com/guides/learn-how-to-read-crypto-charts/

0 Response to "How to Read Btc Short and Btc Long"

Post a Comment